How could you indicate your financial health? Obviously, by showcasing your net worth. Although the questions remain still relevant what does net worth mean and how to calculate it? If you are also one of my confused pals, then you should read this guide.

You will definitely get a reliable definition of this regularly used term in simple and understandable words. Further, I’ll try to include its formula and a template to help you calculate your own net worth in minutes.

So, let’s get into this!

Net Worth Overview

Net Worth is the price of assets that a company or a person have after subtracting all liabilities and expenses. This is a reliable solution to find out a company’s or individual’s financial health or position in the existing era.

Like other financial terms, it is also a quantitative factor that determines your monetary value and position in the market. Here is the formula to calculate the net worth and its factors to understand the formula completely:

Net Worth = Total Assets – Total Liabilities

Assets

Assets are the total monetary value of an identity that he possesses, whether land, investments, or vehicles, like cars and bikes. Let’s take a deeper look at different assets:

- Cash: Cash is the total amount of earned money that an identity reserves in a bank or physically.

- Accounts Receivable: The money that a customer owes to a company, such as bonds and stocks.

- Inventory: Inventory is the type of assets that a company can sell when needed, like products and services.

- Building and Lands: The building and land’s market value that a person reserves.

- Investments: The monetary value of assets that a person invests in a company and is supposed to get revenue.

- Vehicles: Cars, bikes, or any other vehicles are also considered significant in one of types of assets while concluding net worth.

Liabilities

Liabilities are the monetary value that an identity owed instead of owned, whether EMIs, loans, or income tax. Let’s take a deeper look at different liabilities:

- Deferred Revenue: The paid value of a thing that an identity hasn’t received yet is called deferred revenue.

- Lease Obligations: The payable amount of a person that he has to pay for leasing and using anything.

- Accounts Payable: It is the amount of money that a person hasn’t paid yet in reward for products or services.

- Long-Term Debts: Long-term debts are those liabilities that are not paid even after 12 months or one year.

- Income Taxes Payable: This is a payable amount on an employee’s salary package over a year, usually paid by companies.

Now, the formula makes sense. A quantitative value, net worth, will only be calculated through the quantitative factors that are mentioned above.

What are the Types of Net Worth?

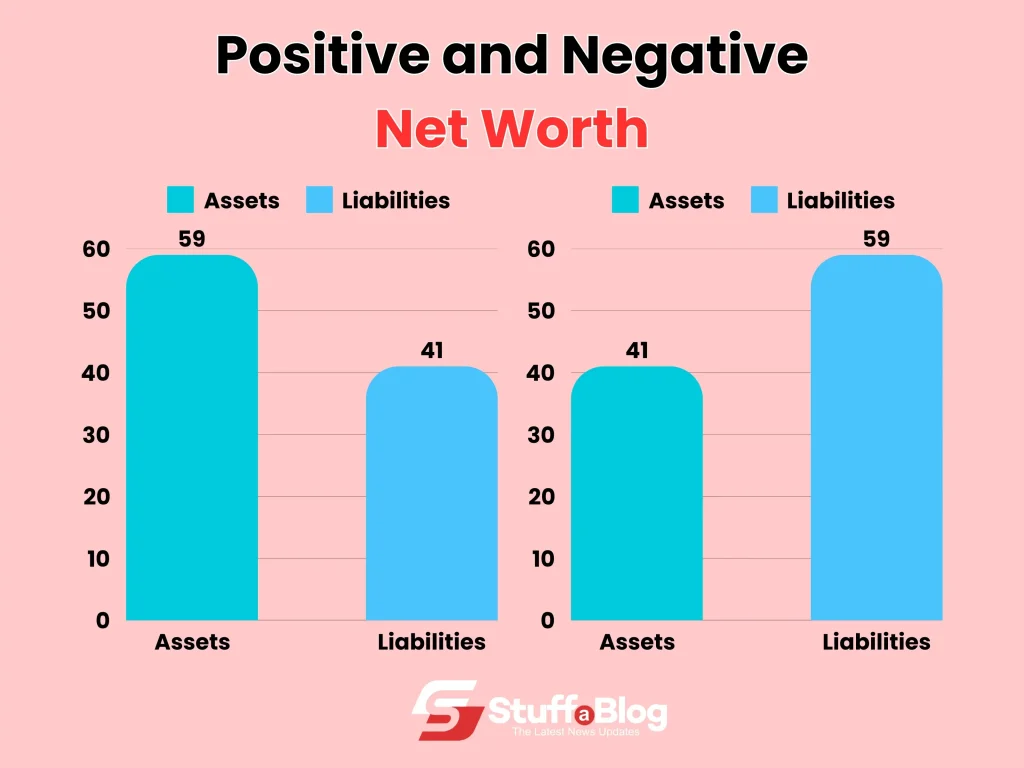

This financial term can be distributed in both positive and negative net worth to indicate an identity’s financial position. Let’s dive a little deeper:

- Positive Net Worth: If you possess higher assets and lower liabilities value, then your net worth is positive.

- Negative Net Worth: If you possess higher liabilities and lower asset value, then your net worth is negative.

The negative perspective of this term is very rare because everybody has some assets that value more than liabilities. Here are some examples of Positive Net Worth from higher to lower.

Positive Net Worth Examples

1. Tom Cruise Net Worth – $600 Million.

2. Brad Pitt Net Worth– $400 Million.

3. Shakira Net Worth – $300 Million.

4. Gordon Ramsay Net Worth – $220 Million.

5. Vanna White Net Worth – $85 Million.

6. Billie Eilish Net Worth – $53 Million.

7. Khaby Lame Net Worth – $40 Million.

How to Calculate Net Worth

The net worth calculation is an easy to conduct process for everyone even if he has little knowledge of mathematics. You just have to identify your assets and liabilities and mark their market value from an expert on the market.

In this way, you will have every factor’s recent value in the market, which is a compulsory action to conduct calculations. Now, put your values in the formula to calculate the exact net worth.

Net Worth = Total Assets – Total Liabilities

Let’s take a practical example of this formula!

What is My Net Worth?

To find out what is your net worth, you have to identify the exact value of your assets in the market and other liabilities. Here, I have assumed the values of your liabilities and assets to calculate.

Assets: $500 in cash, $6000 value of stocks, no inventory, $10,000 residential value, and $400 value vehicle.

Liabilities: $200 deferred revenue, $300 accounts payable, and $100 income tax.

Now, input the value to get the answer.

Net Worth = Total Assets – Total Liabilities

= (500+6000+10,000+400) – (200+300+100)

= (16,900) – (600)

Net Worth = (16300)

According to this formula, your net worth is $16,300.

The Closing Note

Well, in the above section, I have compiled a comprehensive guide on net worth overview and how to calculate it. You may have understood the whole procedure of calculation with the formula that I have mentioned.

If not, then don’t worry, I have also included the whole procedure of calculation along with its template for your ease. You can download the template to know what is my net worth by just putting your assets and liabilities details.