10 Types of Graphic Design Skills and Jobs Profile

When we hear the term graphic design, each of us has a…

Business

All Stories

Stream4u Overview – Watch Free Movies and TV Series

Watching movies online costs you a lot…

How to See Who Blocked You on Facebook – Step by Step Guide

Hey! dude, does your friend have blocked…

Types Of Digital Marketing That Benefit the Most

Are you familiar with digital marketing and…

Entertainment

All Stories

Net Worth

Latest Contents on Stuffablog

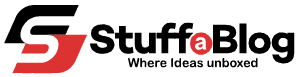

Optimizilla Review – Online Image Compressor for Everyone

Are you tired of bulky images that slow down your website or eating up storage space? Optimizilla is an free…

Deion Sanders Net Worth in 2025 – Early Life and Source of Income

Deion Sanders is one of the most recognized players who has made his name in two fields at a time.…

What Does FRL Mean on Snapchat, TikTok, and Texting?

Have this ever happened to you while texting your friend in a serious discussion,your friend replied with "FRL." This slang…

What Does WYLL Mean in Text, Snapchat & TikTok

Let me guess: you were DMing your old friend on Snapchat, and in response, the reply was, "WYLL." And now…

Who is Zak Doffman – Biography and Net Worth in 2025

Zak Doffman is a prominent figure in cybersecurity due to his unbeatable expertise. He has been working as a contributor…