In this digital world where we all use digital wallets to send payments or use ATMs to withdraw money from our bank accounts, knowing how to write a check is still important. Writing a check is a safe way to make payments.

That’s why it is a helpful thing to learn if you want to pay rent, utility bills, or send gifts or donations via check. If you are a beginner and are thinking about how to write a check for the first time, you may have some common questions in your mind.

In this blog post, I have created a step-by-step guide on how to write a check without making mistakes.

What is a Check?

A check is a written and signed document that asks a bank to pay the mentioned amount of money from a person’s account to the individual or entity named on the check.

Writing a check is a secure and trackable way to transfer funds without using physical cash.

Tips to Know Before You Write a Check

There are some tips you must keep in mind before writing a check for the first time. It will prevent any mistakes and save your time.

- Check your account balance to ensure you have enough money to write a check.

- Use a blue or black pen so that no one can easily change anything on the check.

- Don’t leave any space while writing to avoid fraud.

- Don’t give a signed blank check to anyone.

- If any mistake happens while writing, destroy the check and try to write a new one.

- Keep track of your written checks by using a checkbook with carbon copies.

How to Write a Check? A Step-by-Step Guide

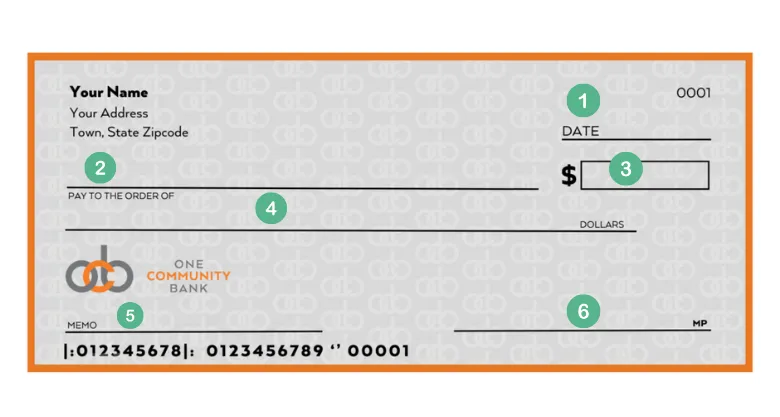

1- Write a Date: Start by writing a date on the top right corner of the check that includes day, month and year. You may also write the date by spelling it.

2- Write about Payee: Clearly write the name of the person or organisation on the payee line that says “Pay to the Order of” and check the spelling to avoid any mistakes.

3- Write Payment in Numbers: There are two places where you need to write about the amount of payment that you need to transfer. Firstly, write your desired payment in numbers in a small box present on the right. Write the payment in dollars and cents.

4- Write Payment in Words: Right beneath the payee line, there’s a line where you need to write your payment in words, followed by the word “only”. For example, if you need to write $143 in words, it will be written as “one hundred and forty-three”.

5- Write a Memo Line: There’s a small line at the bottom left corner of the check that says “Memo”. A memo line tells the bank about why you wrote the check, and it is optional. This step doesn’t affect the bank process, but it can be helpful for you to keep records.

6- Sign the Check: There’s a line on the bottom right corner of the check where you write your name or put your signature. The sign should be the same as the one you used while opening the checking account. This sign will work as confirmation to the bank that you accept this check; otherwise, the check will be rejected.

NOTE: Always keep your checkbook in a safe place to avoid fraud and check forgery, to prevent any alterations on your check.

How to Balance your Checkbook?

After knowing how to write a check, you should also know about balancing your checkbook. Balancing a checkbook means keeping all the records of your transactions in a register. It’ll let you know how much you are spending and how much is still present in your bank account to use in future. All types of transactions should be included in the record, such as checks, ATM withdrawals, card payments and deposits.

To balance your checkbook, you need to follow these two steps:

1- Record Transactions

Every time you write a check to someone, make sure to write all the details in a register to record. Details must include the name of the payee, the amount you are writing, the purpose of the check, and the date on which you are writing the check.

Keep in mind to record every transaction in a record to prevent missing the check. Include ATM withdrawals, debit card payments, deposits, and all other payments.

2- Reconcile Bank Statement Every Month

At the end of every month, make sure to check the bank statement. It should match the record that you are keeping in a register. Double-check if there’s any mistake and take your time to do your math. It’ll help you to avoid any mistakes and keep you updated about our bank balance.

People Also Ask

Q: What happens if I make a mistake?

A: Cross out the error neatly and initial it. If it’s a major mistake, void the check and start a new one.

Q: Is it safe to use checks?

A: Yes, but take precautions. Always fill out all fields, avoid leaving blank spaces, and store unused checks securely.

Q: What if the check is dishonored?

A: In Pakistan, you can file a complaint under the Negotiable Instruments Act or the Pakistan Penal Code within one month of the dishonor date.

Q: Do I need to include cents?

A: Yes, if applicable. Write cents as a fraction (e.g., 75/100) to avoid tampering.