Artificial intelligence is quietly transforming how businesses operate. It also changes how data is analyzed and how decisions are made. Every day, AI helps companies automate complex processes, predict trends, and create smarter products faster.

The rise and penetration of AI into almost every industry has made it a top investment opportunity. The growth margin is quite high and predictable. And that’s the reason AI stocks are grabbing the attention of both new and seasoned investors.

You want to ride the tide?

In this guide, we’ll break down the best AI stocks to buy now and highlight top AI companies to invest in 2025. We’ll also share expert tips to help you navigate this exciting and fast-growing market.

What Makes a Great AI Stock

You need to look beyond hype and focus on fundamentals when investing in AI stocks. The best AI companies to invest in 2025 share a few key qualities:

- They have strong financial health

- They have innovative technology

- Have a clear role in the AI ecosystem

Great AI stocks often lead in areas like semiconductors, cloud computing, data analytics, or enterprise AI tools. They also have competitive advantages such as proprietary technology, loyal customers, or large-scale data access.

These technologies help them to stay ahead. Always keep a balance between growth potential and manageable risk, whether you’re buying big names or exploring cheap AI stocks.

Best AI Stocks To Watch And Buy

1. NVIDIA (NVDA)

Who doesn’t know NVDA? It’s one of the top artificial intelligence stocks and a favorite among investors. Its powerful GPUs drive the computing performance needed for AI training and machine learning applications.

The company’s latest chip architectures power everything from autonomous vehicles to massive data centers. Tech giants building AI models and cloud infrastructure need NVIDIA. Although the stock isn’t cheap, many analysts believe NVIDIA’s leadership in AI chips justifies the price.

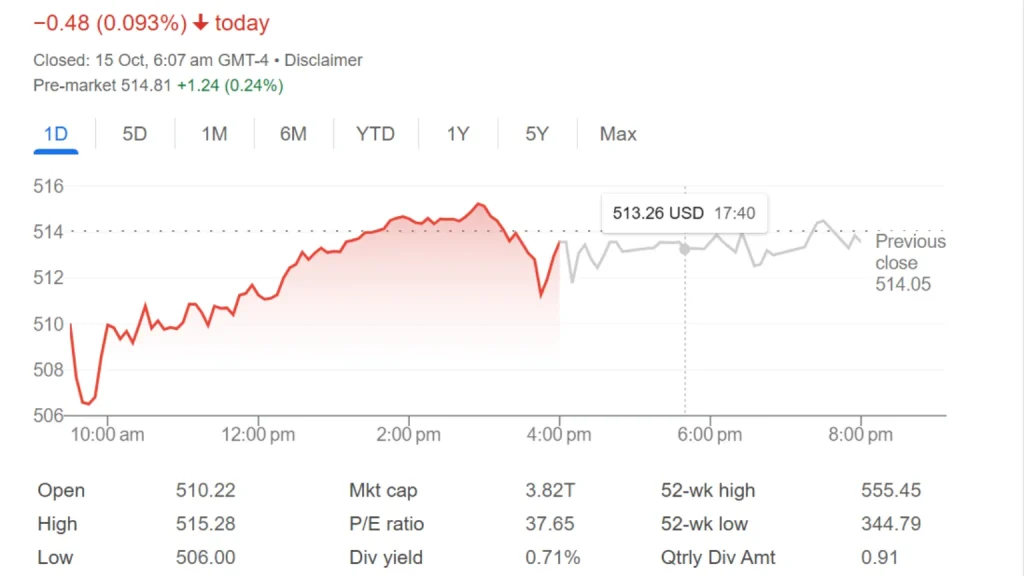

2. Microsoft (MSFT)

Microsoft is another name that consistently appears on lists of top AI stocks to buy in 2025. The company has deeply integrated AI into its products, including Microsoft Copilot, Bing AI, and Azure’s cloud AI services. Its partnership with OpenAI gives it a front-row seat in the generative AI boom.

Microsoft’s ecosystem continues to expand with businesses adopting AI across productivity, security, and cloud operations. According to Forbes, Microsoft’s stock moved 40.1% between April and October 2025, mainly due to a 27.5% change in its P/E ratio.

3. Alphabet (GOOGL)

Alphabet, Google’s parent company, has long been a pioneer in artificial intelligence. AI drives nearly every aspect of its business, from search algorithms and YouTube recommendations to self-driving car technology.

DeepMind and the AI division at Google keep pushing the limits of advanced research. Its new AI model, Gemini, competes strongly in the generative AI race. Alphabet also benefits from its vast data resources, making its AI tools smarter and more efficient.

4. AMD (Advanced Micro Devices)

AMD is quickly catching up in the AI chip race. Often seen as NVIDIA’s main competitor, it offers high-performance GPUs and accelerators used in AI computing. Recent partnerships with major tech firms and cloud providers have strengthened its market position.

Unlike NVIDIA, AMD trades at a slightly lower valuation, making it attractive for investors looking for cheap AI stocks with solid growth potential. However, competition is tough, and margins can fluctuate.

5. Palantir Technologies (PLTR)

Palantir focuses on AI-driven data analytics and platforms that help governments and businesses make smarter decisions. Its software helps organizations analyze complex datasets, predict outcomes, and optimize operations.

The company has seen rising demand from the defense, healthcare, and energy sectors as more industries embrace AI. Palantir’s government contracts provide steady revenue, while its expansion into enterprise markets adds growth potential.

6. Amazon (AMZN)

Amazon is not just an e-commerce leader. It’s also known as a major AI powerhouse. Its AI applications span from product recommendations and Alexa voice assistance to logistics and warehouse automation.

Amazon Web Services (AWS) plays a vital role in global AI development, providing the infrastructure that powers countless AI tools and startups. With continuous investment in AI-driven innovation, Amazon is positioned to benefit from both consumer and enterprise demand.

Expert Tips for Investing in AI Stocks

Before you start investing in AI stocks, it’s smart to understand how to make the most of your money. Here are some expert tips to help you invest wisely and confidently.

- Don’t put all your money in one company: Spread your investment across hardware makers, cloud providers, and AI software firms to reduce risk.

- Look beyond the hype: Focus on companies with real products, customers, and revenue, not just big promises.

- Watch valuations closely: Some AI stocks are expensive. Enter when prices make sense and avoid buying at extreme highs.

- Follow partnerships and contracts: When a company secures big AI deals or partnerships, it’s often a sign of strong future growth.

- Stay updated on regulations: AI laws, data rules, and export bans can impact company profits and stock performance.

- Think long term: AI adoption is growing fast, but true profits take time. Be patient with your investments.

- Add a mix of leaders and newcomers: Combine reliable giants like Microsoft and NVIDIA with smaller, promising AI firms for balance.

- Reinvest your profits wisely: If your AI stocks perform well, reinvest some of the gains to grow your portfolio steadily.

- Keep learning: The AI market changes quickly. Therefore, stay informed so you can adjust your strategy when needed.

Comparing Top AI Stocks

If you’re comparing the best AI stocks to buy now, the table below highlights each company’s risk level and what makes them stand out in the fast-growing AI market.

| Company | Risk Level | Why It’s Worth Watching |

| NVIDIA (NVDA) | Medium to High | Dominates AI chip production; essential for training large AI models and data centers. |

| Microsoft (MSFT) | Medium | Strong AI integration across its ecosystem, including Azure, Copilot, and a partnership with OpenAI. |

| Alphabet (GOOGL) | Medium | Deep AI research, diverse products, and massive data advantage are driving consistent innovation. |

| AMD (Advanced Micro Devices) | Medium to High | Cheaper alternative to NVIDIA with growing demand for AI chips and new cloud partnerships. |

| Amazon (AMZN) | Medium | AI powers AWS, logistics, and retail personalization; solid long-term growth potential. |

| Palantir Technologies (PLTR) | High | Specializes in AI-driven data analytics for government and enterprise clients; strong niche focus. |

Risks to Consider Before Investing

Not everything is rainbows and butterflies in AI stock investments. There are risks, too. And you should be aware of them..

- Some AI stocks are really pricey right now. If growth slows, their prices can drop quickly.

- The AI world is super competitive. Even big companies can get overtaken by newcomers.

- Digital tools and technologies change fast. What’s hot today might feel old news next year.

- Sometimes chip shortages or supply issues can mess with a company’s profits.

- Governments are getting stricter with data and exports, and that can affect AI firms.

- Stock prices can jump up and down a lot, so short-term investing is tricky.

- And most importantly, don’t get carried away by hype; always check the facts before investing.

Final Words

AI is changing the way we live and work, and investing in this space can be really exciting. There are big opportunities with companies like NVIDIA, Microsoft, and Alphabet, but it’s important to stay careful and balanced.

Remember, valuations, competition, and technology changes all play a role in how these stocks perform. Patience is key in this market. AI adoption takes time, and real profits may take years to materialize.

Frequently Asked Questions

Startups gain attention through innovative products, big partnerships, or rapid growth in niche AI markets.

Often yes, because AI is rapidly evolving, and small news or tech breakthroughs can cause big price swings.

Most high-growth AI companies reinvest profits into research, so dividends are rare at this stage.

It depends on your strategy. Hardware offers essential infrastructure, while software often grows faster and scales globally.